While credit cards offer convenience, purchase protection, and rewards, they also come with a potentially costly feature: interest charges. Credit card interest represents one of the most expensive forms of consumer debt, with average rates exceeding 20% APR—significantly higher than mortgage, auto, or personal loan rates. Understanding how credit card interest works and implementing strategies to avoid these charges can save you thousands of dollars over time and help maintain your financial health.

This comprehensive guide explains the mechanics of credit card interest, how it impacts your finances, and proven strategies to eliminate or minimize interest charges.

How Credit Card Interest Actually Works

Credit card interest involves several components that determine how much you’ll pay when carrying a balance:

Annual Percentage Rate (APR)

The APR represents the yearly cost of borrowing money, expressed as a percentage. Credit cards typically have several different APRs:

- Purchase APR: The standard rate applied to regular purchases

- Balance transfer APR: The rate for transferred balances from other cards

- Cash advance APR: Usually higher than purchase APR, applied to cash withdrawals

- Penalty APR: Often the highest rate, triggered by late payments or other violations

Most credit cards have variable APRs tied to a financial index (typically the prime rate) plus a margin determined by the issuer based on your creditworthiness.

Daily Periodic Rate (DPR)

Credit card companies convert the APR to a daily rate for interest calculations:

- DPR = APR ÷ 365 (or 360 for some issuers)

- For a 20% APR: 20% ÷ 365 = approximately 0.055% daily interest

Average Daily Balance Method

Most credit card issuers use this method to calculate interest:

- They track your balance at the end of each day in the billing cycle

- These daily balances are added together

- The sum is divided by the number of days in the billing cycle

- This average daily balance is multiplied by the DPR

- That figure is multiplied by the number of days in the billing cycle

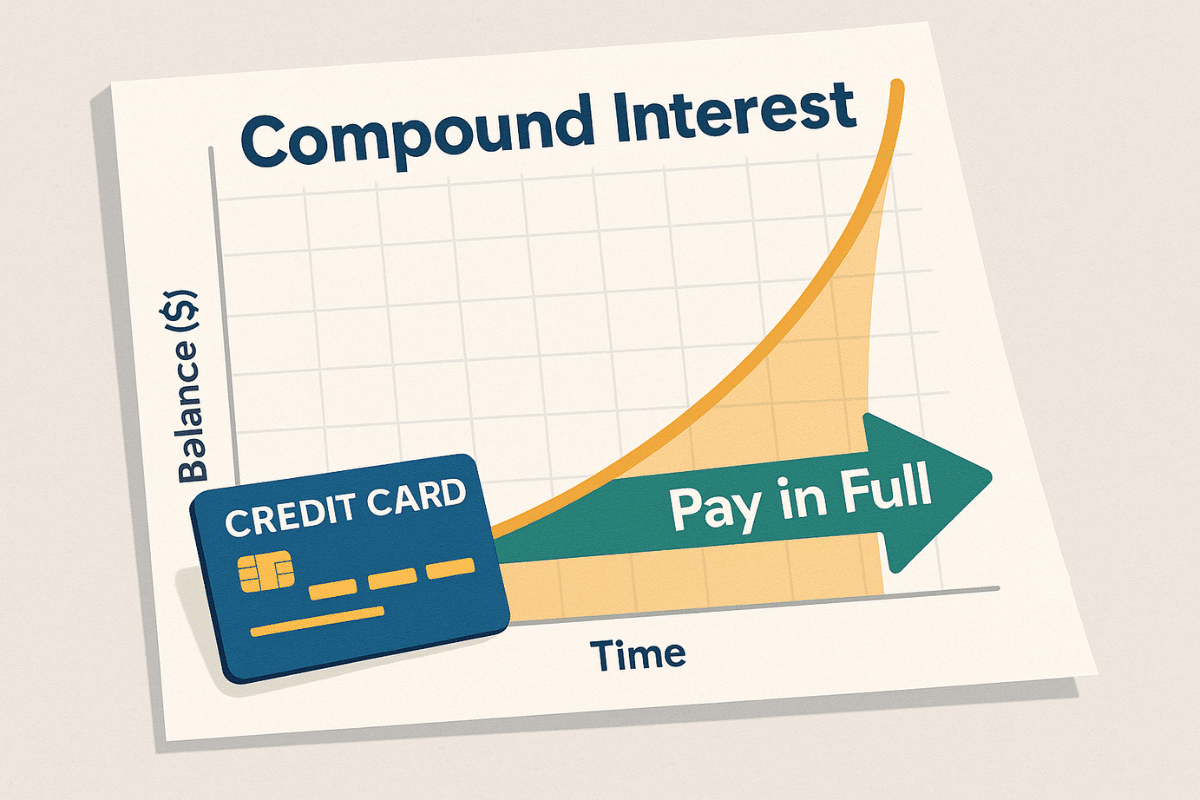

This method means that every day you carry a balance, interest compounds—interest charges are added to your principal balance, and the next day’s interest is calculated on that new, higher amount.

Compounding Interest Example

Let’s see how interest accumulates on a $1,000 balance with a 20% APR over a 30-day month:

- DPR = 20% ÷ 365 = 0.055% per day

- Day 1: $1,000 × 0.055% = $0.55 interest

- Day 2: $1,000.55 × 0.055% = $0.55 interest

- Day 30: After a month, total interest = approximately $16.67

Over a year, this compounding effect means you’d pay about $200 in interest on that initial $1,000—not just the $200 simple interest calculation ($1,000 × 20%) would suggest.

The Grace Period: Your Key to Avoiding Interest

One of the most valuable features of credit cards is the grace period—the time between the end of a billing cycle and your payment due date during which no interest accrues on new purchases.

How Grace Periods Work

- Typically lasts 21-25 days after your billing cycle closes

- Applies only to new purchases, not cash advances or balance transfers

- Only available if you paid your previous balance in full by the due date

This means if you pay your statement balance in full each month by the due date, you essentially receive an interest-free loan for your purchases from the purchase date until payment—potentially up to almost two months of free financing.

Losing Your Grace Period

If you don’t pay your balance in full, you lose this valuable benefit:

- Interest begins accruing on new purchases immediately

- Interest applies to your previous unpaid balance from the original purchase date

- You must typically pay two consecutive statements in full to reinstate your grace period

Factors That Determine Your Credit Card Interest Rate

Several elements influence the interest rate you’re offered:

Credit Score Impact

Your credit score significantly affects your assigned APR:

- Excellent credit (740+): Typically qualifies for rates 7-10% below average

- Good credit (670-739): Usually near or slightly below average rates

- Fair credit (580-669): Typically 3-7% above average rates

- Poor credit (below 580): May face rates 10%+ above average

Card Type Influence

Different card categories carry different average interest rates:

- Rewards and travel cards: Generally have higher APRs to offset benefits

- Student cards: Often slightly higher than average due to limited credit history

- Secured cards: Typically have higher rates despite being backed by deposits

- Store cards: Usually carry the highest rates, often 25-30%

Economic Factors

Broader economic conditions affect card interest rates:

- Federal Reserve policy decisions directly impact the prime rate

- Changes to the prime rate automatically adjust variable APRs

- Economic uncertainty may lead issuers to increase margins over the prime rate

The True Cost of Carrying a Credit Card Balance

To illustrate how expensive credit card interest can become, consider these scenarios:

Minimum Payment Trap

Making only minimum payments on a $5,000 balance with a 20% APR:

- Typical minimum payment: 2% of balance or $25, whichever is greater

- Initial minimum payment: $100

- Time to pay off: Approximately 38 years

- Total interest paid: About $11,400

- Total repayment: $16,400 (more than three times the original balance)

Fixed Payment Example

Paying a fixed $250 monthly payment on the same $5,000 balance:

- Time to pay off: 24 months

- Total interest paid: About $1,100

- Total repayment: $6,100

This comparison demonstrates how minimum payments maximize interest profits for card issuers while keeping consumers in debt for decades.

Strategic Approaches to Avoid Credit Card Interest

Implement these proven strategies to eliminate or minimize interest charges:

The Full Payment Strategy

The simplest and most effective approach:

- Pay your statement balance in full every month by the due date

- Set up automatic payments to ensure you never miss a deadline

- Budget for credit card payments as bills, not revolving debt

- Track spending throughout the month to ensure you can pay in full

For Existing Balances: Debt Elimination Tactics

If you’re already carrying balances, consider these approaches:

Balance Transfer Strategy

- Transfer high-interest balances to cards with 0% promotional periods

- Typical offers range from 12-21 months interest-free

- Usually involve 3-5% transfer fees

- Create a repayment plan to eliminate the balance during the promotional period

Debt Avalanche Method

- List all credit card balances with their APRs

- Make minimum payments on all cards

- Direct extra money to the highest-interest balance first

- After paying off one card, redirect that payment to the next highest-interest card

- Mathematically the most efficient interest-reduction strategy

Debt Snowball Method

- Similar to avalanche but prioritizes lowest balance first

- Provides psychological wins through faster account payoffs

- Less efficient mathematically but often more motivating

Debt Consolidation Options

- Personal loans with lower fixed rates (typically 6-36% depending on credit)

- Home equity products (if you own a home) with much lower rates (though they add risk to your home)

- 401(k) loans (though these carry significant retirement planning implications)

Preventative Measures for Future Interest Avoidance

Build these habits to prevent future interest charges:

Budgeting for Credit Card Spending

- Only charge what you can pay off when the bill arrives

- Track credit purchases as if they’re debit transactions

- Maintain a buffer in your checking account to cover credit card payments

- Consider using budgeting apps that integrate with your credit accounts

Strategic Use of Multiple Payment Cycles

- Make multiple payments throughout the month

- Time large purchases just after statement closing dates to maximize grace period

- Set calendar reminders for statement closing and payment due dates

Using Technology to Prevent Interest

- Set up account alerts for approaching due dates

- Use automatic payment features for at least the minimum due

- Monitor accounts through banking apps to track balances and due dates

Special Interest Situations to Watch For

Be aware of these situations that can unexpectedly increase interest costs:

Deferred Interest Promotions

Common with store credit cards and financing offers:

- Advertised as “0% interest if paid in full by [date]”

- If not paid completely by the end of the promotional period, interest is charged retroactively on the original purchase amount

- Can result in sudden, large interest charges

- Different from true 0% APR promotions, which do not charge retroactive interest

Cash Advance Complexity

Cash advances are particularly expensive:

- No grace period—interest begins accruing immediately

- Higher APR than standard purchases (often 5% higher)

- Additional cash advance fees (typically 3-5% of the advance amount)

- Often last to be paid off under standard payment allocation rules

Penalty APR Triggers

Actions that can activate much higher penalty interest rates:

- Late payments (especially 60+ days late)

- Exceeding your credit limit

- Returned payments (bounced checks)

- Violations of other cardholder agreement terms

Penalty APRs can legally reach 29.99% and may apply to your account indefinitely.

Understanding Your Rights Regarding Credit Card Interest

Several regulations protect consumers regarding credit card interest:

CARD Act Protections

The Credit Card Accountability, Responsibility, and Disclosure Act provides important safeguards:

- Issuers must give 45 days’ notice before increasing your APR

- Rate increases generally can’t apply to existing balances (with exceptions)

- Issuers must review accounts with rate increases every six months

- Payments above the minimum must be applied to highest-interest balances first

Statement Disclosure Requirements

Credit card statements must clearly show:

- How long it will take to pay off your balance making only minimum payments

- How much you need to pay monthly to eliminate the balance in three years

- Total interest costs of minimum payments versus three-year payoff

Your Right to Reject Changes

If your card issuer increases your APR:

- You have the right to reject the increase

- Your account will be closed to new charges

- You can pay off the existing balance at the old rate

- This option protects you from sudden rate hikes on existing balances

Interest Avoidance and Your Credit Score

Strategic interest management can positively impact your credit score:

Utilization Impact

Paying down balances improves your credit utilization ratio:

- Utilization accounts for approximately 30% of your FICO score

- Keeping utilization below 30% (ideally below 10%) boosts scores

- Paying in full each month ensures the lowest possible reported utilization

Credit Mix Consideration

Responsibly managing revolving credit demonstrates financial capability:

- Having credit cards with zero or low balances improves your credit mix

- This factor accounts for about 10% of your FICO score

- Shows lenders you can handle different types of credit responsibly

Payment History Foundation

Avoiding interest through on-time payments strengthens the most important credit factor:

- Payment history influences approximately 35% of your FICO score

- Consistent, full payments demonstrate financial responsibility

- Autopay features help ensure this critical factor remains positive

Conclusion: The Interest-Free Approach to Credit Cards

Credit card interest represents an entirely optional cost—one that financially successful consumers typically avoid. By understanding how interest works, implementing strategic payment practices, and using credit cards as payment tools rather than lending instruments, you can enjoy the numerous benefits of credit cards without paying interest charges.

The simplest strategy remains the most effective: pay your statement balance in full every month by the due date. This approach transforms what could be an expensive borrowing tool into a beneficial financial instrument that provides convenience, purchase protection, fraud security, rewards, and improved credit scores—all without costing you interest.

If you’re currently carrying balances, creating a deliberate debt elimination plan using the techniques outlined in this guide can help you transition to this interest-free approach to credit card use, potentially saving you thousands of dollars over your financial lifetime.