Your credit score functions as a financial report card, providing lenders with a quick assessment of your creditworthiness. This three-digit number falls somewhere on a spectrum from poor to excellent, with each range carrying distinct implications for your financial opportunities. Understanding where your score falls and what it means can help you make informed decisions about credit applications, recognize improvement opportunities, and set realistic financial goals.

Let’s explore the standard credit score ranges, what they mean for your financial life, and strategies to move from one range to the next.

Understanding Credit Score Scales

Before diving into specific ranges, it’s important to understand the two main scoring models used in the United States:

FICO Score Range: 300-850

The FICO score, created by the Fair Isaac Corporation, remains the most widely used scoring model among lenders. FICO scores range from 300 (lowest) to 850 (highest), with higher scores indicating lower credit risk.

VantageScore Range: 300-850

VantageScore, developed collaboratively by the three major credit bureaus (Experian, Equifax, and TransUnion), also uses a 300-850 scale in its current versions (VantageScore 3.0 and 4.0).

While both models use the same numerical range, they categorize score levels somewhat differently and calculate scores using slightly different methodologies. For simplicity, this article will focus primarily on FICO score ranges, as they remain the standard for most lending decisions.

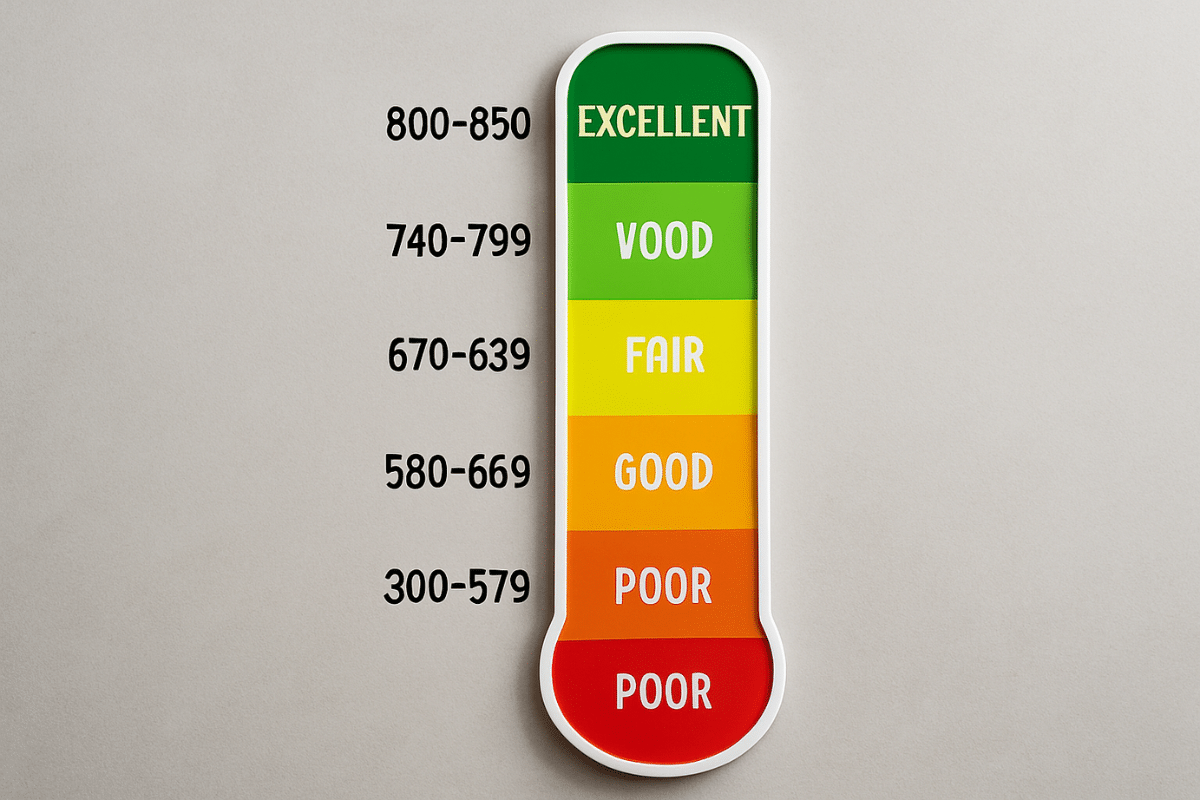

The Five Credit Score Range Categories

Credit scores typically fall into five distinct categories, each with its own implications for your financial options:

Excellent/Exceptional Credit: 800-850

Percentage of Americans: Approximately 20% of consumers have scores in this elite range.

What it means: An excellent credit score places you among the most creditworthy borrowers. With scores in this range, you:

- Qualify for the lowest interest rates available

- Receive approval for virtually any credit product

- Enjoy the highest credit limits

- Access premium rewards credit cards

- Face minimal or no security deposits for utilities and services

- Benefit from preferential terms on insurance premiums in many states

Typical profile: Consumers with excellent credit typically have:

- Lengthy credit histories (often 7+ years)

- Perfect or near-perfect payment records

- Multiple credit accounts in good standing

- Very low credit utilization ratios (often below 10%)

- Few or no recent credit inquiries

- Diverse credit mix including revolving and installment accounts

Financial impact: The difference between excellent and merely good credit can save thousands of dollars over the life of a mortgage and hundreds annually on auto loans, insurance premiums, and credit card interest.

Very Good Credit: 740-799

Percentage of Americans: About 25% of consumers fall in this range.

What it means: With very good credit, you’re still considered a low-risk borrower. At this level, you:

- Qualify for favorable interest rates, though not always the absolute lowest

- Receive approval for most credit products

- Enjoy generous credit limits

- Access most premium rewards cards

- Often avoid security deposits

- Benefit from better-than-average insurance rates in many states

Typical profile: Consumers with very good credit generally have:

- Established credit histories (usually 5+ years)

- Few, if any, late payments, and none recent

- Multiple credit accounts in good standing

- Low credit utilization (typically below 20%)

- Limited recent credit inquiries

- A mix of different credit types

Financial impact: The step from good to very good credit often represents significant savings, particularly on major loans like mortgages.

Good Credit: 670-739

Percentage of Americans: Approximately 21% of consumers have scores in this range.

What it means: Good credit places you near the U.S. average. With this score range, you:

- Qualify for most credit products, though not always with the best terms

- Receive interest rates close to the national average

- Access moderate credit limits

- Qualify for many rewards credit cards

- May face minimal security deposits

- Pay standard rates for insurance in states that use credit-based insurance scoring

Typical profile: Consumers with good credit typically have:

- Established credit histories (generally 3+ years)

- Mostly on-time payments, with perhaps a few late payments

- Multiple credit accounts, most in good standing

- Moderate credit utilization (often 20-30%)

- Some recent credit inquiries

- Some variety in credit types

Financial impact: Moving from fair to good credit significantly expands financial opportunities and can save substantial money on major purchases and insurance premiums.

Fair Credit: 580-669

Percentage of Americans: About 18% of consumers have scores in this range.

What it means: Fair credit scores suggest higher lending risk. With this range, you:

- Face higher interest rates on approved loans and credit cards

- May be declined for certain premium credit products

- Receive lower credit limits

- Have limited options for rewards credit cards

- Often encounter security deposit requirements

- Pay higher insurance premiums in states that use credit-based insurance scores

Typical profile: Consumers with fair credit often have:

- Shorter or inconsistent credit histories

- Several late payments on record

- Higher credit utilization rates (frequently above 30%)

- Possibly some derogatory marks like collections

- Several recent credit inquiries

- Less diverse credit mix

Financial impact: The difference between fair and good credit can add thousands to the cost of a car loan or mortgage and significantly limits access to the best financial products.

Poor Credit: 300-579

Percentage of Americans: Approximately 16% of consumers fall into this category.

What it means: Poor credit scores indicate substantial credit risk. In this range, you:

- Face difficulty obtaining traditional credit products

- Encounter the highest interest rates when approved

- Receive minimal credit limits

- Have access primarily to secured credit cards and subprime loans

- Need substantial security deposits for utilities and rentals

- Pay significantly higher insurance premiums where credit-based pricing is allowed

Typical profile: Consumers with poor credit typically have:

- Limited credit history or significant negative history

- Multiple late or missed payments

- Possible serious delinquencies, collections, or public records

- Very high credit utilization or maxed-out credit cards

- Potential bankruptcy history

- Limited variety in credit accounts

Financial impact: Poor credit can cost tens of thousands of dollars over a lifetime in higher interest, increased deposits, and limited financial opportunities.

How Lenders View Different Score Ranges

Lenders typically set their own thresholds for approval, with internal policies that may differ from the standard ranges above. Here’s how different types of lenders might view these credit score categories:

Mortgage Lenders

- Conventional mortgages: Generally require scores of 620+, with the best rates at 740+

- FHA loans: May approve scores as low as 500 with a larger down payment, but typically prefer 580+

- VA loans: No official minimum from the VA, but lenders typically look for 620+

- Jumbo loans: Usually require 700+ or even 720+ for the best terms

Auto Lenders

- Prime auto loans: Typically require 660+ for good rates

- Subprime auto financing: Available for scores below 600, but with much higher interest rates

- Auto lease agreements: Often require scores of 700+ for approval

Credit Card Issuers

- Premium rewards cards: Generally require 720+ or even 740+

- Standard rewards cards: Typically accessible at 670+

- Basic unsecured cards: May approve scores of 600+

- Secured credit cards: Available for scores below 600

Personal Loan Providers

- Traditional banks: Typically require 660+ for competitive rates

- Credit unions: May consider scores of 600+ with existing relationships

- Online lenders: Some will work with scores as low as 580, but rates increase significantly below 650

The Real-World Impact of Different Credit Score Ranges

Credit score ranges affect more than just approval odds—they directly impact your financial bottom line. Here’s how different ranges might affect a typical consumer:

Mortgage Cost Example

For a $300,000 30-year fixed mortgage:

- Excellent (800+): 5.4% APR = $1,685 monthly payment, $306,607 total interest

- Very Good (740-799): 5.6% APR = $1,722 monthly payment, $319,991 total interest

- Good (670-739): 5.9% APR = $1,780 monthly payment, $340,688 total interest

- Fair (580-669): 6.5% APR = $1,896 monthly payment, $382,680 total interest

- Poor (below 580): May not qualify for conventional mortgage

The difference between excellent and fair credit in this example: $42,000+ in additional interest over the loan term.

Auto Loan Example

For a $25,000 5-year auto loan:

- Excellent (800+): 4.5% APR = $466 monthly payment, $2,945 total interest

- Very Good (740-799): 5.5% APR = $476 monthly payment, $3,582 total interest

- Good (670-739): 7.5% APR = $501 monthly payment, $5,025 total interest

- Fair (580-669): 11.5% APR = $549 monthly payment, $7,957 total interest

- Poor (below 580): 14.5% APR = $586 monthly payment, $10,173 total interest

The difference between excellent and poor credit: $7,200+ in additional interest over the loan term.

Credit Card Example

For a $5,000 credit card balance:

- Excellent (800+): 13.99% APR = $5,371 total cost if paying $250 monthly

- Very Good (740-799): 16.99% APR = $5,452 total cost if paying $250 monthly

- Good (670-739): 19.99% APR = $5,535 total cost if paying $250 monthly

- Fair (580-669): 23.99% APR = $5,645 total cost if paying $250 monthly

- Poor (below 580): 26.99% APR = $5,735 total cost if paying $250 monthly

The difference between excellent and poor credit: $364 in additional interest while paying off the balance.

Beyond Financial Products: Other Areas Impacted by Credit Score Ranges

Your credit score range affects more than just loan terms:

Housing Opportunities

- Rental applications: Many landlords set minimum score requirements, often around 620-650

- Security deposits: Lower scores typically require larger deposits

- Utility connections: Poor credit may require deposits for basic services

Insurance Premiums

In most states, insurers use credit-based insurance scores to help determine:

- Auto insurance premiums (differences can exceed $1,500 annually between highest and lowest score tiers)

- Homeowners insurance rates

- Renters insurance costs

Employment Opportunities

While employers don’t see your actual credit score, they may review your credit report for certain positions related to:

- Financial responsibilities

- Executive roles

- Government positions requiring clearance

- Jobs involving confidential information

Mobile Phone Contracts

- Service contract approval: Major carriers typically check credit

- Phone financing: Better rates and terms with higher scores

- Security deposits: May be required with lower scores

How To Check Which Range Your Credit Score Falls Into

To determine your current credit score range:

Free Options

- Credit card providers: Many offer free FICO scores on statements or through online portals

- Banking services: Some banks and credit unions provide complimentary scores

- Credit monitoring sites: Services like Credit Karma, Credit Sesame, and NerdWallet offer free VantageScore access

- Annual credit reports: While these don’t include scores, reviewing your reports at AnnualCreditReport.com helps identify factors affecting your score

Paid Options

- FICO.com: Purchase access to your FICO scores from all three bureaus

- Credit bureau websites: Experian, Equifax, and TransUnion sell scores directly

- Credit monitoring services: Premium services typically include scores and monitoring

When checking your score, note which model and version you’re viewing, as this affects the range interpretation.

Strategies to Improve Your Score Within Each Range

No matter where your credit currently stands, targeted strategies can help you move to the next range:

Moving from Poor to Fair (300-579 → 580-669)

Focus on establishing stability and addressing negative items:

- Bring all accounts current if possible

- Consider secured credit cards to establish positive payment history

- Pay down existing debt, focusing on accounts in collections

- Dispute inaccurate negative information on your credit reports

- Become an authorized user on a family member’s well-established account

- Consider a credit builder loan from a credit union

Timeline: Expect 12-24 months of consistent positive behavior to see meaningful improvement.

Moving from Fair to Good (580-669 → 670-739)

Work on building positive history and reducing utilization:

- Maintain perfect payment history going forward

- Reduce credit card balances to below 30% of limits

- Avoid applying for multiple new accounts

- Continue paying down outstanding collections

- Add a mix of credit types if you only have one type

- Keep old accounts open to preserve credit history length

Timeline: With consistent positive behavior, reaching good credit typically takes 12-18 months from the fair range.

Moving from Good to Very Good (670-739 → 740-799)

Focus on optimization and excellence:

- Reduce credit utilization to below 10% if possible

- Eliminate all but essential credit applications

- Ensure perfect payment history across all accounts

- Monitor your credit reports regularly to address any issues quickly

- Maintain a diverse mix of credit accounts

- Be patient as your credit history lengthens

Timeline: Moving from good to very good typically takes 6-12 months of optimized credit behavior.

Moving from Very Good to Excellent (740-799 → 800-850)

Perfect your credit profile with fine-tuning:

- Maintain low utilization consistently across all revolving accounts

- Continue perfect payment history

- Limit new credit applications to only essential needs

- Allow your accounts to age (average age of accounts is important)

- Address any remaining negative items through goodwill letters or negotiation

- Maintain a healthy mix of credit types

Timeline: Reaching excellent credit often takes years of consistently responsible credit management.

Common Misconceptions About Credit Score Ranges

Several myths about credit score ranges persist:

Myth: You Need Perfect 850 Scores

Reality: There’s virtually no benefit to having an 850 versus an 800. Lenders typically offer their best terms to anyone above 760-780.

Myth: Checking Your Score Lowers It

Reality: Checking your own score creates a “soft inquiry” that doesn’t affect your score. Only “hard inquiries” from credit applications impact scores.

Myth: Closing Old Credit Cards Improves Your Score

Reality: Closing old accounts can actually hurt your score by reducing your available credit and potentially shortening your credit history.

Myth: Income Affects Your Credit Score

Reality: Income isn’t factored into credit scores, though it is considered separately by lenders in affordability assessments.

Myth: Married Couples Share Credit Scores

Reality: Credit scores are individual, not joint. Spouses often have significantly different scores based on their individual credit histories.

Building and Maintaining Healthy Credit Across All Ranges

Regardless of where your score currently stands, these habits promote positive credit health:

- Pay all bills on time, every time

- Keep credit card balances low relative to your limits

- Apply for new credit sparingly and only when needed

- Regularly monitor your credit reports for errors or fraud

- Maintain a mix of credit types when possible

- Keep old accounts active with occasional use

- Create a budget that ensures debt remains manageable

- Set up automatic payments to avoid missed due dates

- Address problems quickly if you’re struggling to make payments

Conclusion: Your Credit Journey

Your credit score isn’t a fixed trait but rather a reflection of your ongoing financial behaviors. Understanding the different score ranges helps you assess where you stand and what opportunities are available to you.

Remember that improving your score is a marathon, not a sprint. Each positive step you take—from making on-time payments to reducing debt—contributes to your upward movement through the credit score ranges. With patience and consistent responsible credit management, you can achieve and maintain excellent credit, unlocking the best financial opportunities and saving potentially tens of thousands of dollars throughout your lifetime.

No matter where you start, the path to better credit begins with understanding these ranges and implementing targeted strategies to advance to the next level. Your future financial self will thank you for the effort.